Pawsitively Protected

Pet Business Insurance for the Purr-fect Professionals

Get peace of mind while doing what you love! Protect your pet services business with affordable, customizable insurance coverage starting at just $154/year.

Don't Just Take Our Word For It:

Hear From Some of Our 15,000+ Pet Business Clients

Affordable, Fast, and Comprehensive

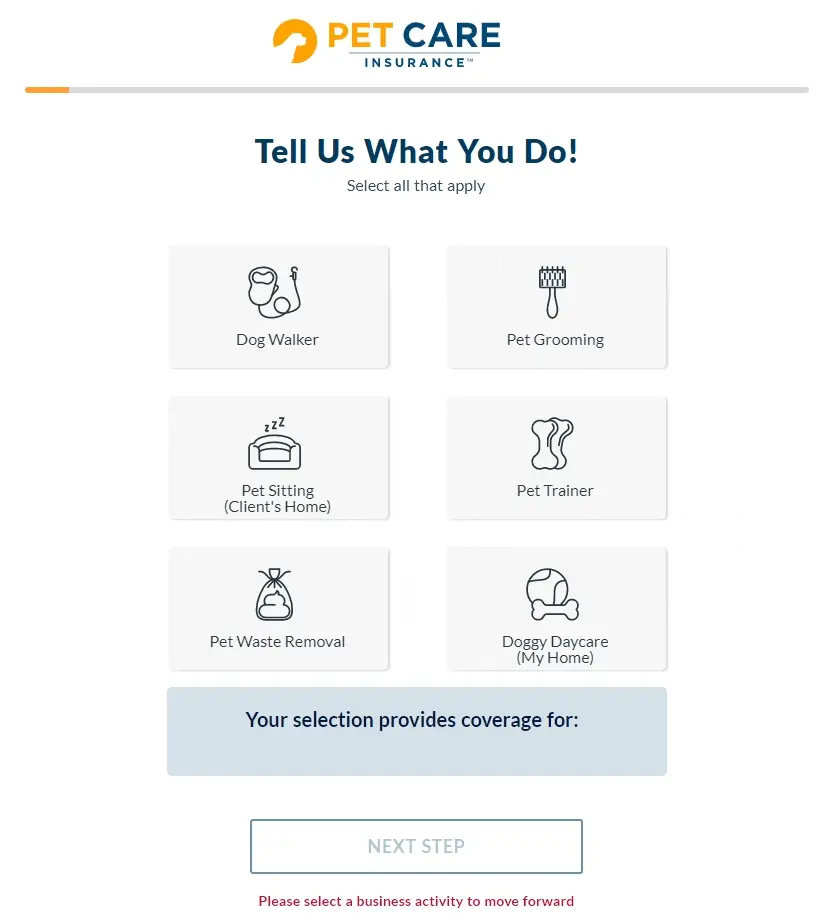

Our Pet Business Liability Coverage is Designed to Meet Your Unique Needs

Customizable Policies

Get only the coverage you need, and save money by not paying for coverage you don't need.

Instant COI

Get a certificate of insurance instantly to book gigs faster and increase your revenue.

Simplified Coverage

Streamline year insurance coverage and reduce paperwork by covering multiple services under one policy.

Who Needs Pet Business Liability Insurance?

Dog Trainers

Don't let accidents bite you - liability insurance for pet sitters.

Pooper Scoopers

Our insurance takes the stink out of pooper scooping liability.

Doggy Daycare

Keep tails wagging and clients happy with comprehensive insurance.

Pet Sitting Insurance Coverage Details

If you’re looking for pet sitting insurance, you’ve come to the right place. Pet Care Insurance provides customized pet sitter insurance through “A” rated carriers.

Limits of Insurance

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business services.

Limit per Incident: $1,000,000

Limit per Year: $2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services.

The amount that your policy will pay for claims arising out of one or more of the following offenses:

- False arrest, detention or imprisonment

- Malicious prosecution

- Wrongful eviction or wrongful entry

- Oral or written publications that slander or libel a person or organization

- Oral or written publication or material that violates a person’s right of privacy

- The use of another’s advertising idea in your advertisement

The maximum your policy will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business services.

$1,000,000

Applies to damage by fire to premises rented to the insured; also applies to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

Any One Premises: $100,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

Any One Person: $5,000

This provides your pet business with coverage in the event that you are legally liable for injuries or damages sustained by an animal in your care, custody, or control.

Limit per Incident: $5,000

Limit per Year: $10,000

This provides coverage for medical expenses—regardless of who is at fault—for a client’s pet in your care, custody, or control.

Limit per Incident: $1,000

Limit per Year: $5,000

Deductible: $250

If you were to lose the keys to a client’s residence, this coverage could help you manage the cost of installing new locks or having the building rekeyed.

Limit per Incident: $2,000

Limit per Year: $2,000

*Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions.