Pet Care Insurance 101

Liability Insurance can be a lifesaver for a pet care professional if an unexpected accident or lawsuit strikes. It can also make your business more credible or help you meet requirements to open the door to new opportunities. But understanding the ins and outs can be a daunting task. Frankly, it’s downright confusing for most pet care professionals. This resource is here to help you navigate the world of liability insurance so you can make an informed decision and feel confident that you’re choosing the right coverage for your pet care business.

Trusted by over 15,000 Pet-care Professionals

What is liability insurance and what does it cover?

General Liability

Think of General Liability Insurance as a safety net for your pet care business. It shields you from any wrongs that could cause harm to someone’s body, property, or reputation.

Say a customer gets hurt in your dog grooming salon, and they sue you. The insurance covers their medical bills and legal fees. We’ve seen pet care professionals face lawsuits from customers tripping over chairs or tables. It sounds silly, but it happens.

It also pays for any damage you cause to your client’s property. For instance, you accidentally dent a client’s garage door while maneuvering a heavy crate into your pet taxi. With general liability insurance, you could have the repairs covered.

Animal Liability

Animal Liability is part of your General Liability coverage that pays claims for physical harm to other people, property, or animals caused by pets in your care.

If a dog you’re walking bites someone, fights with another dog during daycare, or scratches up a client’s door while you’re pet sitting, animal liability helps pay the bill (so you don’t have to). You can use up to $200,000 per year of your general liability limit to pay for these types of claims.

Products & Completed Operations

Products & Completed Operations coverage acts as a protective shield for pet care professionals who sell products and provide services. Many pet care groomers offer products as part of their services. In the event that a pet owner or their pet suffers an injury or damage as a result of your products or services, even after the completion of your work or the sale of your product, this coverage can help mitigate the financial burdens of potential legal actions or compensation claims that may arise.

For example, let’s say you groom a client’s pet, and a few days later, they notice a skin irritation or allergic reaction. In such a situation, this coverage ensures that you are protected in case the pet owner seeks compensation from you.

Personal & Advertising Injury

Personal & Advertising Injury coverage helps protect your business’s good name. It’s like a rainy day fund when someone accuses you of doing something wrong like lying about a competitor or using someone else’s stuff without permission. If you get accused of these things, you might end up in court, but this insurance can help cover the costs.

You might be competing with another pet sitter for business and in your advertising, you make some claims. You would be protected if that competitor came after you with allegations.

Damage to Premises Rented to You

Damage to Premises Rented to You Coverage can protect your business from the cost of damage caused to a rented location, like a groomer or doggy daycare space. If you accidentally damage a rented space, it can help cover the cost of repairs.

This coverage is designed for short-term rentals, typically lasting a few days. It should be seen as a supplement to, not a replacement for, comprehensive property insurance. If you’re renting a space for seven or more consecutive days, this policy only covers damage from fires.

Medical Expense Limit

Medical Expense Limit helps if someone gets hurt on your property or due to your business operations. This coverage only pays for medical expenses, not other costs like lost wages or pain. It’s important to have because it can help you avoid paying medical bills from your own pocket. This applies even if you’re not legally responsible for the injury.

Think of General Liability Insurance as a safety net for your pet care business. It shields you from any wrongs that could cause harm to someone’s body, property, or reputation.

Say a customer gets hurt in your dog grooming salon, and they sue you. The insurance covers their medical bills and legal fees. We’ve seen pet care professionals face lawsuits from customers tripping over chairs or tables. It sounds silly, but it happens.

It also pays for any damage you cause to your client’s property. For instance, you accidentally dent a client’s garage door while maneuvering a heavy crate into your pet taxi. With general liability insurance, you could have the repairs covered.

Animal Liability is part of your General Liability coverage that pays claims for physical harm to other people, property, or animals caused by pets in your care.

If a dog you’re walking bites someone, fights with another dog during daycare, or scratches up a client’s door while you’re pet sitting, animal liability helps pay the bill (so you don’t have to). You can use up to $200,000 per year of your general liability limit to pay for these types of claims.

Products & Completed Operations coverage acts as a protective shield for pet care professionals who sell products and provide services. Many pet care groomers offer products as part of their services. In the event that a pet owner or their pet suffers an injury or damage as a result of your products or services, even after the completion of your work or the sale of your product, this coverage can help mitigate the financial burdens of potential legal actions or compensation claims that may arise.

For example, let’s say you groom a client’s pet, and a few days later, they notice a skin irritation or allergic reaction. In such a situation, this coverage ensures that you are protected in case the pet owner seeks compensation from you.

Personal & Advertising Injury coverage helps protect your business’s good name. It’s like a rainy day fund when someone accuses you of doing something wrong like lying about a competitor or using someone else’s stuff without permission. If you get accused of these things, you might end up in court, but this insurance can help cover the costs.

You might be competing with another pet sitter for business and in your advertising, you make some claims. You would be protected if that competitor came after you with allegations.

Damage to Premises Rented to You Coverage can protect your business from the cost of damage caused to a rented location, like a groomer or doggy daycare space. If you accidentally damage a rented space, it can help cover the cost of repairs.

This coverage is designed for short-term rentals, typically lasting a few days. It should be seen as a supplement to, not a replacement for, comprehensive property insurance. If you’re renting a space for seven or more consecutive days, this policy only covers damage from fires.

Medical Expense Limit helps if someone gets hurt on your property or due to your business operations. This coverage only pays for medical expenses, not other costs like lost wages or pain. It’s important to have because it can help you avoid paying medical bills from your own pocket. This applies even if you’re not legally responsible for the injury.

Types of Claims from Pet Care Professionals

We get it, accidents happen. Some people get insurance because it’s required for their job. But the other benefit is it helps small businesses defend themselves from those accidents. Here are some claims pet care professionals like yourself protected themselves from with the right coverage.

Covered.

Covered.

Covered.

Covered.

Covered.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

Additional (Optional) Coverage

You often have the ability to customize your coverage. That’s where additional coverage comes in. These optional coverages let you add to your coverage to cover additional things your base policy doesn’t cover.

Pet Protection Coverage (Animal Bailee)

Animal Bailee protects the animals in your care, custody, or control. As a pet care professional, the pets are the star of your business. While base liability coverage protects people, this protects pets. If a pet suffers an injury while under your care, this coverage protects you from the costs.

At PCI, we believe this coverage is essential for pet professionals, so we include coverage in your base policy. From 2021-2023, 56% of claims were not covered by GL but were covered by Pet Protection (Animal Bailee) Coverage.

Veterinarian Reimbursement

Veterinarian Reimbursement protects your pockets while you’re on the clock. If an accident happens or a pet gets sick, requiring you to make an emergency trip to the vet, this coverage reimburses for what you paid out of pocket – up to the limit amount.

Like Pet Protection Coverage, we see this impacting pet professionals all the time and include coverage in our base policy. From 2021-2023, 25% of claims were not covered by GL but were covered by Veterinarian Reimbursement.

Equipment & Inventory (Inland Marine)

Equipment & Inventory coverage (Inland Marine Insurance) protects your business equipment. This insurance is made for things that move around, like dryers, clippers, kennels, food, and shampoos.

If any of that stuff gets damaged, lost, or stolen, Inland Marine coverage pays for fixing or replacing it. It does not cover anything permanent like buildings or lighting installations. It does not cover damage to property by one of the animals in your care.

If you work out of your house, you may think your Homeowner or Renter’s Insurance covers your equipment. But those coverages are intended for personal property. They either exclude business property or offer low limits. To protect your business property, you need Equipment & Inventory coverage.

At PCI, we offer $4,000 of Equipment & Inventory coverage for only $4.08 a month and up to $50,000 in coverage for $22.42 a month.

Broadened Property Damage Coverage

Broadened Property Damage Coverage helps you if a client’s property is damaged while in your care. It covers incidences that General Liability coverage wouldn’t protect. For instance, a pet sitter used a client’s bathroom and didn’t realize the toilet was broken, resulting in a flood. Because they had Broadened Property Damage Coverage, they were covered and didn’t have to pay the costs of fixing the bathroom.

At PCI, we offer $25,000 of yearly coverage for just $2.42 a month.

Employee Dishonesty Coverage

Some pet care professionals run a business with employees. Employee Dishonesty Coverage protects your business if an employee commits theft, embezzlement, or fraud. It can also cover if a client suffers financial loss damages or loss due to an employee’s actions or negligence.

Additional Insureds

Additional Insureds are like extra people or organizations that are covered by your insurance policy. This could include things like a venue, property owner, or event planner. It’s not for friends, business partners, other pet care professionals, or yourself.

For example, let’s say you’re renting a building and someone gets hurt leaving. They could sue both you and the building owner. If the owner is listed as an additional insured on your policy, your insurance can help cover the costs for both you and the owner.

Online Protection Insurance (Cyber Liability)

As pet care professionals rely more on technology, they face more risks of cyber attacks. Online Protection Insurance protects you from losses caused by these attacks, such as data breaches or ransom payments. This insurance covers costs like legal fees and credit monitoring services for customers affected by the attack.

It’s important to consider if you take some sort of payment online through Stripe, Venmo, PayPal, etc. That means you are storing customer information. If someone ever got ahold of that data, you’d need Online Protection Insurance to be protected.

Endorsements

Endorsements are like add-ons to your insurance policy. They can help cover risks that your standard policy doesn’t. They can also change your coverage to fit your business better.

PCI offers the following endorsements to give pet care professionals the protection they need:

- Pet Groomers: Protection for professional groomers beyond basic washing and brushing.

- Pet Sitters: Protection for professionals who stay at a client’s home, do drop-in visits, etc.

- Pet Trainers: Protection for professionals who teach commands beyond basic sit, stay, and come.

- Doggy Daycare: Protection for professionals who provide overnight care at your business, perform daytime care and exercise for pets, etc.

Workers Compensation Coverage

Pet care is physically hard, from lifting heavy carriers to the potential for nervous pets to bite or scratch. Workers compensation is designed to pay for medical bills, recovery costs, lost wages, and more if one of your team members gets hurt caring for pets. This coverage is required in some states if you have employees, so check your local employment laws.

Common Questions/Confusions

Why Do I Need Insurance?

Buy Policy

What Do You Mean by Coverage Limits?

Coverage Limits are the most your insurance will pay for a specific kind of problem. If the claim costs more than the limit, you have to pay the rest yourself.

Explain the Difference Between Premiums and Deductibles

When you buy insurance, you pay for protection from certain risks. This protection is called coverage, and you pay for it with a premium. It’s like paying to have the insurance company ready to help you when you need it. Deductibles are the money you agree to pay first before your insurance coverage starts.

For example, if you have a $500 deductible on your car insurance and there’s $2,000 of damage from an accident, you pay the first $500, and your insurance covers the other $1,500.

What are Exclusions?

Your insurance policy won’t cover everything. Exclusions are things that your policy specifically says it won’t cover. For example, if your policy excludes training guard dogs, then it won’t pay out if have claims in relation to training guard dogs.

What’s the Difference Between Aggregate and Occurrence Limits?

Imagine you have a General Liability policy for your salon. This policy helps protect you in case you get sued for things like property damage or bodily injury caused by your business activities.

Your policy might have Aggregate coverage and Occurrence coverage limits for bodily injury claims. The Aggregate limit is like a total limit for all bodily injury claims that happen during the policy period. The Occurrence limit is like a limit for each individual bodily injury claim.

Let’s say your policy has an Aggregate limit of $1 million and an Occurrence limit of $500,000 for bodily injury claims. If one person sues you, the insurance company pays up to $500,000 under the Occurrence limit. If you have multiple claims, they’ll pay up to a total of $1 million under the Aggregate limit.

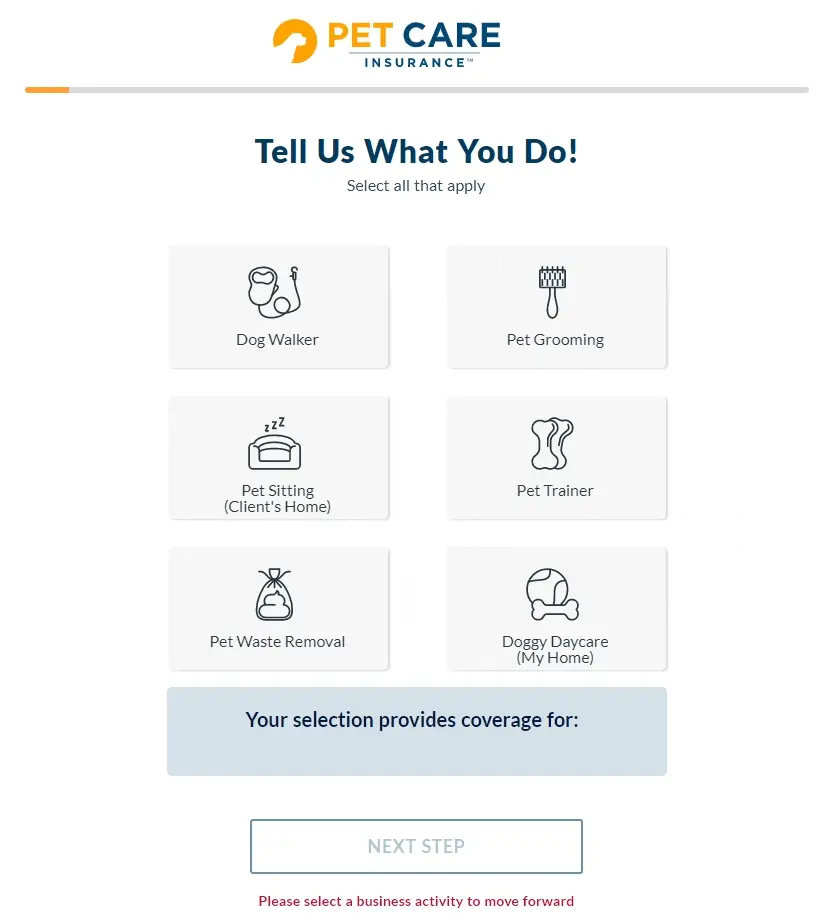

How Pet Care Insurance Simplifies Getting Insurance

Fast, seamless coverage

We’ve revolutionized how you get Pet Care Insurance. Simply answer a few questions related to your pet care business and the coverage you need, and get you a quote and instant coverage with a certificate of insurance in 10 minutes or less. If you don’t need the coverage to start today, you can purchase it up to 90 days before your coverage starts.

Online coverage management makes things a breeze

We think your insurance should be as flexible as your business. That’s why we’ve focused on making it easy to manage everything online. Once you purchase your policy, you’ll get access to a personalized dashboard where you can add endorsements, additional insureds, or Equipment & Inventory coverage at any time.

If you ever need to cancel your policy, you can do it from your dashboard without needing to speak with a rep. But, if you need help, a rep will walk you through the process.

Claims made easy

We know you’d rather not have to file a claim. But, if you have to, you can easily file your claim online in just a few minutes through your online dashboard by simply filling out the online form with your contact information and details about the incident.

After you’ve submitted a claim, you’ll receive an email with your claim number and the Claims Adjuster’s contact information — while our team receives a copy of the loss notice.

From there, within 24–48 business hours, our team will reach out by email or phone to gather any additional information needed in order to continue with the claim. The claim then gets reviewed by the carrier, and if it’s approved, we settle the claim!

We work hard to get claims paid out as quickly as possible, this usually just depends on when the claimant is able to provide us with the information needed. If a claim is not covered, you’ll receive a letter explaining why it was not covered.

Chris Graham and his team are always ready to help answer your questions. Sweater and sunglasses not always included.

We Don’t Have Sales Agents, We Have Service Agents

Instead of trying to make a sale for commission, our certified agents are here to answer all of your questions so you can make the best decision for your pet care business. You won’t deal with barks or bites with PCI, just friendly people who love pets as much as you do.

Available Monday through Friday, from 6 AM to 6 PM MST, our best-in-class support is ready to answer your questions over the phone or chat.

95%

of customers are very likely to recommend PCI after working with our agents.

About PCI

Our goal is simple: provide pet sitters, dog walkers, groomers, and other small pet businesses with affordable insurance solutions with flexible policy options. We have insured more than 800 pet care businesses and sold more than 100,000 policies online in a variety of industries.

years of Experience

Pet Care Professionals

Industries covered

We are proud to now serve tens of thousands of small businesses each year. Our insurance is reliable and flexible, meeting the needs of beauty professionals everywhere—including yours.

Ready to get protected?